property tax assistance program illinois

There may be some assistance available for delinquent property taxes in Winnebago County Illinois. Check Your Eligibility Today.

Disabled Veterans Property Tax Exemptions By State

As mentioned above property tax relief mechanisms generally provide relief by exempting a portion of a property s assessed value from taxation or abating the amount of taxes paid.

. The Senior Citizen Real Estate Tax Deferral Program. Any negotiated program will be effective after the local government officials have thoroughly reviewed the owners ability to pay and the request from. To see if you qualify give us a call today at 312-626-9701or fill outthe form below to have one of our representatives give you a call.

Check Your Eligibility Today. Illinois has received approval from the US. Starting in April 2022 the state will begin accepting applications from homeowners for grants of up to 30000 to eliminate or reduce.

There are many offices that hold different pieces of information about your property tax and this page is intended to get you to the answer with as few clicks as possible. The property must be occupied for 10 continuous years or 5 continuous years if the person receives assistance to acquire the property as part of a government or non-profit housing program. Aand information on financial assistance programs for elderly Illinois residents is available here.

The Senior Citizen Real Estate Tax Deferral program is a tax-relief program that works like a loan. Welcome to the Illinois Tax Assistance Website. With many families and businesses losing income due to the stay-at-home order amid.

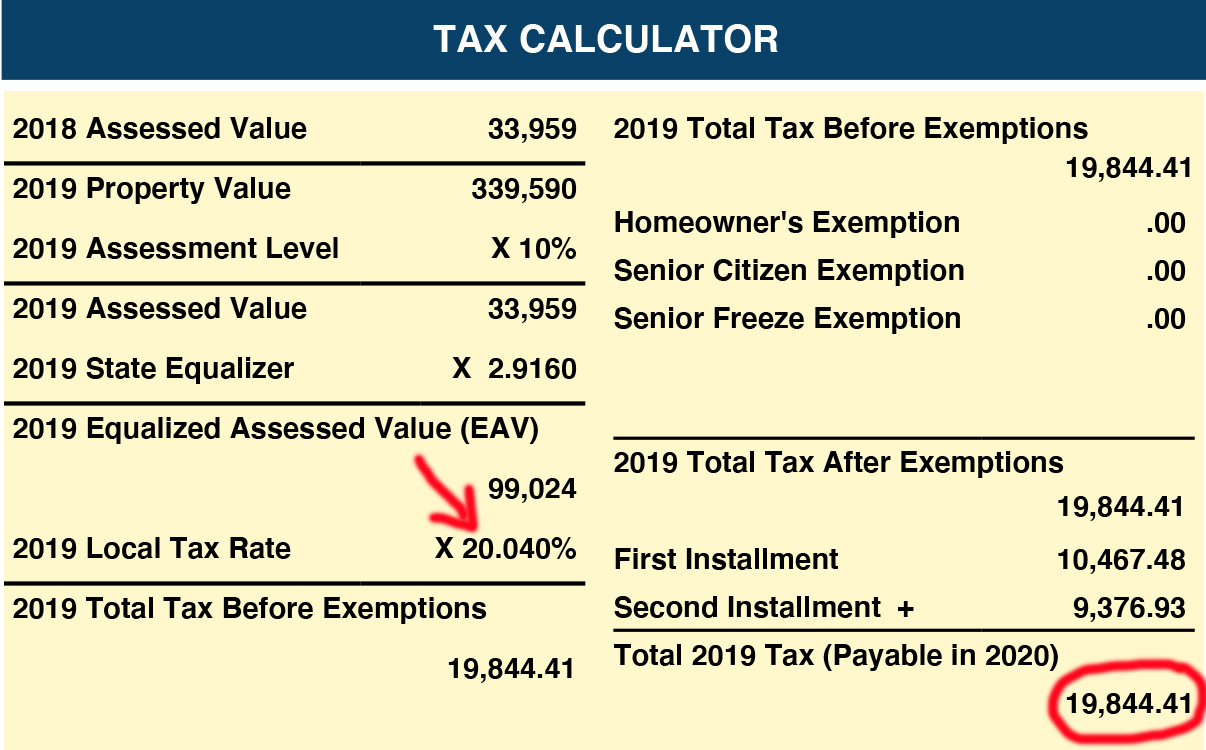

Ad 2022 Latest Homeowners Relief Program. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. If a home has an EAV of 200000 its tax value would be 190000.

The loan from the State of Illinois is paid when the property is sold or upon the death of the participant. An exemption reduces the property s assessed value and may be in the form of a percentage of that value or a reduction of that value. This page is your source for all of your property tax questions.

Mortgage Relief Program is Giving 3708 Back to Homeowners. Illinois property tax bills are on their way and payment is due in June. So if a propertys EAV is 50000 its tax value would be 40000.

Districts must apply annually if they wish to be considered for the future grant cycles. Call us today to find out if you qualify for one of our progra. Beginning January 1 2001 legislation will take effect that may significantly increase the.

The homeowner or homestead exemption allows you to take 10000 off of your EAV. The Program will provide 560 million in property tax relief and 453 million in pharmaceutical assistance to Illinois senior citizens. The money can be used by the client of the program for up to.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. I recommend that you visit the Illinois Property Tax Appeal Board Taxpayer Assistance Web page to learn about what assistance may be available. Overview of the Illinois Hardest Hit Fund known as the Emergency Loan Program.

Ad Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. Department of the Treasury on its Illinois Homeowner Assistance Fund ILHAF program to provide assistance to Illinois homeowners who have struggled to pay their mortgage due to COVID-19. This exemption limits EAV increases to a specific annual percentage increase that is based on the total household income of 100000 or less.

I hope this information helps you Find. The 10000 reduction is the same for every home no matter its market value or EAV. The Cook County Treasurers Office website was designed to meet the Illinois Information Technology Accessibility Act.

Jan 22 2010. FORMS OF PROPERTY TAX RELIEF. Search 84 million in available property tax refunds.

Under the proposed relief ordinance interest penalties for late payments of the second installment of property taxes which are normally due August 3 will now be postponed until October 1. We have funds available for delinquent taxes on a first come first served basis and assistance can only be given to one property per Illinois homeowner. The Circuit Breaker Property Tax Relief program provides rebates to qualified seniors for rent property taxes or nursing home charges.

Check If You Qualify For 3708 StimuIus Check. Illinois Property Tax Assistance Program is available for property owners who need help today. The Property Tax Relief Grant PTRG is a one year grant program.

Macon County Property Tax Information. Any payments made on or before October 1 for property tax second installments will be considered filed and paid on time by Cook County Treasurer Maria Pappas. 31 rows Purpose of the Property Tax Relief Program.

Check Your Eligibility Today. Ad Mortgage Relief Program is Giving 3708 Back to Homeowners. Some programs allow the creation of property tax installment plans for property owners who are delinquent in paying taxes as a result of saying being unemployed for the last several months.

Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility. The program will provide low to moderate income homeowners in Illinois a zero percent interest loan that needs to be used to pay their housing expenses such as their mortgage property taxes insurance and other expenses. Homeowners Relief Program is Giving 3708 Back to HomeownersCheck Your Eligibility.

It allows qualified seniors to defer a maximum of 5000 per tax year this includes 1st and 2nd installments on their primary home. However please note that beginning FY 20 any recipient of the PTRG will need to file the abatement for 2 years.

Illinois Property Tax Exemptions What S Available Credit Karma Tax

Understanding The Tax Cycle Lake County Il

Property Tax Relief How It Works Credit Karma

Illinois Taxes Illinois Economic Policy Institute Illinois Economic Policy Institute

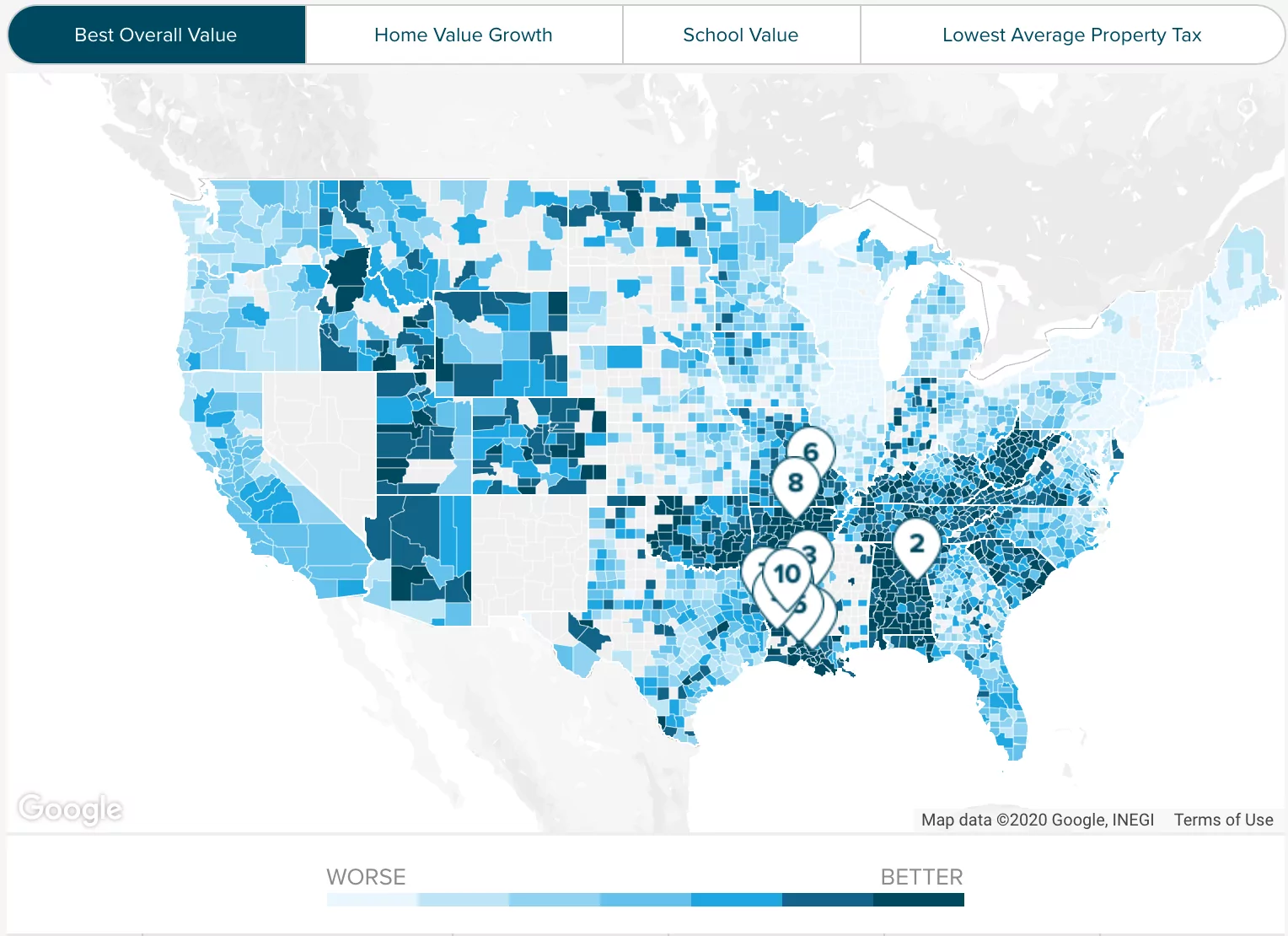

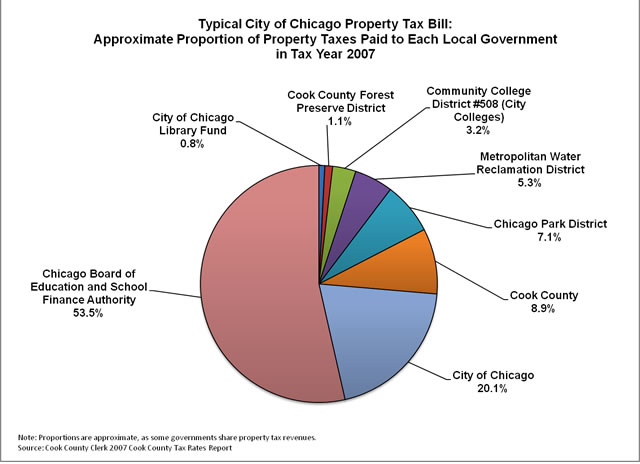

Where Do Your Property Tax Dollars Go The Civic Federation

Cook County Treasurer S Office Chicago Illinois

Gov Jb Pritzker S Budget Plan Offers Tax Relief Wbez Chicago

Longtime Homeowner Exemption Cook County Assessor S Office

Your 2020 Cook County Tax Bill Questions Answered Medium

Expected 7 5 Billion In Federal Aid Won T Fix Illinois Budget Crisis Without Structural Reforms

Ildeptofrevenue Ildeptofrevenue Twitter